In the world of pharmaceuticals, we’ve mastered the art of using data and dashboards to drive decisions. Now, we see a similar opportunity in the insurance sector. It’s not just about numbers; it’s about making those numbers work for you.

Why Data and Dashboards Matter

The insurance industry, with its rich history and foundational role in modern economies, has always been data-driven . Every policy written, every claim processed, and every customer interaction has always generated data. But in today’s digital age, the volume, velocity, and variety of this data have increased exponentially. We’re not just talking about numbers in a ledger anymore – we’re talking about real-time data streams, customer interactions on digital platforms, and complex datasets that involve the nuances of modern insurance operations.

Agents, the frontline warriors of the industry, are more than just salespeople. They’re data gatherers. Every interaction, every feedback, every challenge faced in the field adds to the industry’s repository of data. Then there are the policy details, underwriting, claim histories, and customer feedback loops. This huge trove of information, if harnessed correctly, holds the potential to reshape how insurance agencies operate, serve their customers, and position themselves in a competitive market.

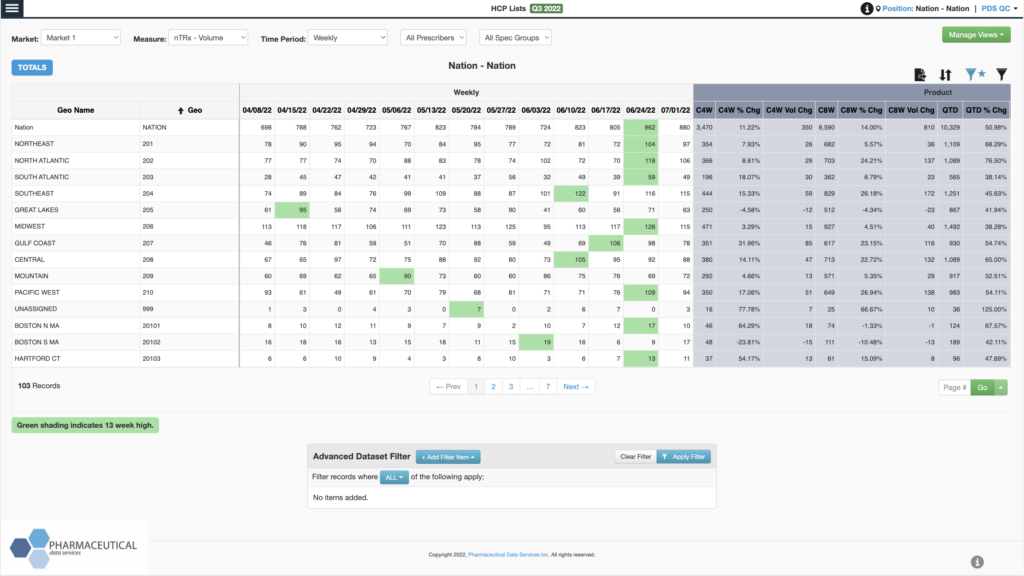

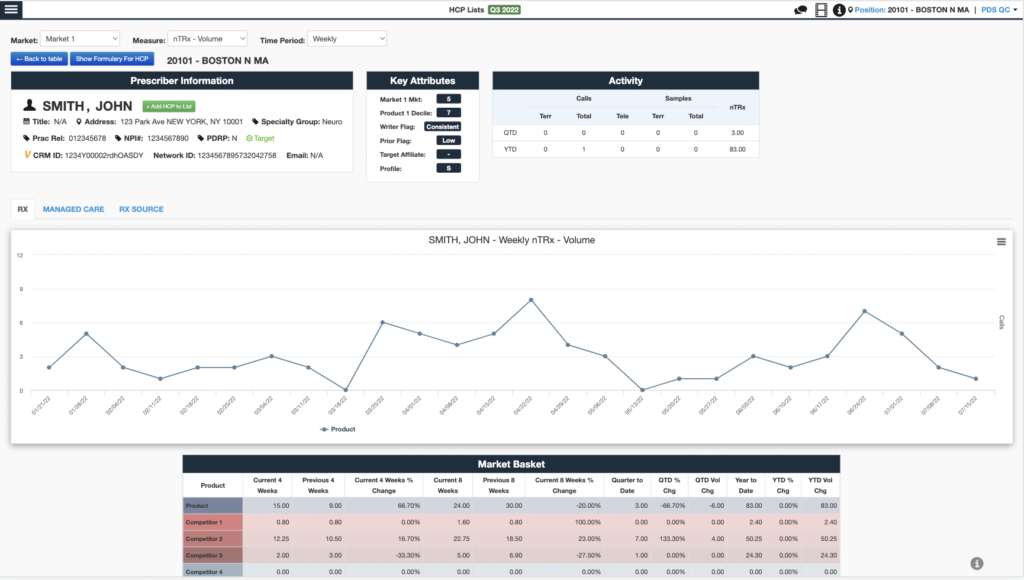

However, raw data, no matter how comprehensive, is like an untold story. It holds potential, but without the right tools and expertise, its narratives remain hidden. This is where dashboards come into the picture. They’re not just tools – they’re storytellers. Dashboards help you sift through vast datasets, identify patterns, trends, and anomalies, and present these insights in a visual, interactive, and comprehensible way. They transform abstract numbers into tangible insights.

Consider this analogy: if data is the raw footage of a film, then dashboards are the directors. They decide what gets highlighted, what gets cut, and how the story gets told, ensuring the audience (in this case, the insurance agencies) gets a clear, concise, and actionable view of the narrative.

Benefits at a Glance:

- Streamlined Processes: With clear visuals and real-time data, agencies can quickly identify bottlenecks, inefficiencies, and areas ripe for innovation. It’s about working smarter, not harder.

- Informed Decisions: In the world of insurance, every decision has ripple effects. With dashboards, these decisions are grounded in solid data, ensuring that strategies are proactive rather than reactive.

- Enhanced Performance: Agents are the backbone of the industry. By continuously tracking their metrics, agencies can provide timely feedback, set realistic targets, and ensure that their workforce is equipped to meet the challenges of the modern insurance landscape.

Revamping HR and Recruitment with Data

The insurance industry, like other sectors, is undergoing a transformation. As the industry evolves, so does the need for skilled professionals who can navigate its complexities. This places a significant responsibility on HR and recruitment teams. They’re not just filling positions; they’re shaping the future of their organizations.

The Intricacies of HR and Recruitment in Insurance

The HR and recruitment landscape in insurance is multifaceted. It’s not just about hiring agents- it’s about finding the right fit for a number of different of roles, from underwriters and claims adjusters to data analysts and customer service representatives. Each role has its unique requirements, challenges, and contribution to the agency’s overall success.

Every step in the recruitment process, whether it’s drafting a job description, screening applicants, conducting interviews, or onboarding new hires, is a data point. These data points, when collected and analyzed, offer a goldmine of insights. For instance, which recruitment channels yield the best candidates? What skills are in high demand but short supply? Which training programs have the highest impact on employee performance?

Harnessing Data for Strategic Recruitment

By diving deep into this data, insurance agencies can craft more effective recruitment strategies. They can identify which roles have high turnover rates and delve into the reasons. They can spot trends in the talent market, ensuring they stay competitive in attracting top talent. It’s about being proactive, anticipating needs, and addressing challenges before they become roadblocks.

Dashboards: The HR Partner

Enter dashboards. These powerful tools take the vast amounts of HR and recruitment data and transform it into actionable insights. With a glance, HR teams can monitor the effectiveness of their recruitment campaigns, track the progress of new hires during the onboarding process, and even predict future recruitment needs based on company growth and industry trends.

Moreover, dashboards aren’t just about recruitment. They play an important role in employee management. By tracking performance metrics, feedback scores, and training outcomes, HR teams can ensure that employees aren’t just satisfied but are thriving in their roles. They can identify training needs, spot high-performing employees ripe for promotions, and even predict attrition risks.

Taking Workflows to the Next Level

Every insurance agency has its workflows. Whether it’s processing claims, underwriting policies, or training agents, there’s a method to the madness. But what if we could make these methods more efficient? By harnessing the power of data and visualizing it on dashboards, agencies can spot trends, predict future challenges, and stay one step ahead.

The future of insurance is data-driven. But data alone isn’t the key; it’s how you use it. With the right dashboards, insurance agencies can transform their operations, making them more efficient and effective. At the end of the day, it’s about providing better services, and with data and dashboards by our side, we’re well on our way.